In addition payment history makes up 35 of your FICO Score. In one year youll have paid off an additional 420 of the principal.

/GettyImages-1158728857-eade4de9daf04c7f904627b888d84b03.jpg)

6 Ways To Cut The Cost Of Your Car Loan

Even if your credit score dips slightly from paying off your car loan it may be worth paying off early if you have a high-interest.

. Used Car Loan Starting APR. The terms of your loan are based on your credit score. Often you will see ads from dealers offering to pay off your current cars financing so you can get into a newer car.

A lower interest rate saves you money throughout your auto loan term and. As always follow smart budgeting and car-buying advice. If you have perfect credit you receive the lowest possible interest rate.

8 Not Making a Down Payment. Paying off a loan with a high interest rate can certainly be challenging. Steps for Refinancing Your Auto Loan.

If you have a lower debt-to-income ratio or. For example if your monthly payment is 265 round it up to 300 by making an extra 35 payment. Make a down payment of 20 of the cars sale price so you wont be.

It does not give them a warm and fuzzy feeling about your ability to. Check our financing tips and find cars for sale that fit your budget. Instead of making the required monthly payment consider rounding up your payments say to the nearest 50.

Aim to pay 10 to 20 of the vehicles price tag and know that taxes and fees will take a chunk of it. The average interest rate on a used car loan was 965 in the first quarter of 2020 compared to 561 on a new. If you put half of your refund toward an extra car loan payment of 125 each month you would pay off your auto loan a year and two months early saving 767 in interest.

You can either lower your interest rate or lengthen your loan. How to Shop Around and Compare Lenders. So before you decide to refinance you should know these four important things.

If you have a low credit score you should consider holding off on a car purchase. Tighten Up Your Credit. Apply for Auto refinancing.

With refinancing you typically have two options. If you took out a five. 1 PenFed Credit Union.

Thankfully an easy way to beat the interest on your car loan is by refinancing. 5 hours agoThe best way to get a lower rate is to improve your credit score. Another tactic that can help you save money on a simple interest auto loan is a method known as payment splitting Because interest accrues on a daily basis the sooner a.

Determine how much money you owe on your car loan. Refinancing is a great way to save. To get the best interest rate youll need an LTV of 80 or less.

Take the next step Our advisors will help to. 2 Pay off your credit card balances to get a lower APR. Here are several key points to keep in mind.

Dealer finance isnt always the best option. One of the factors. You may also save a bit of money in interest.

This may be helpful as many people feel pressured to go. If you dont you have to pay more. In addition to your current lender you should compare the.

For instance if you have high-interest credit card debt and a low-interest car loan you should focus on paying off the high-interest debt first. At PenFed rates for 36-month refinance loans start as low as 299. Heres seven ways to get a better interest rate on your car loan.

Potential lenders hate to see you with high credit card balances. Get a pre-approved loan before you buy a car. Round up your payments.

Save up a down payment and use a car loan calculator to double-check your budget. New Car Loan Starting APR. 1 Deep discounts are available for members who use the credit unions car buying service with rates starting as low as.

The average interest rate on a new car loan was 382 for the best credit scorers while those with the lowest credit scores carried new car loans with 1425 interest rates on average. Rates on new-car loans tend to be lower than rates on used-car loans. When you are able to make a substantial down payment on a new or used vehicle you will likely also be able to get a good financing deal.

If youve already taken out an auto loan and want to reduce the existing APR you can refinance the loan to a lower APR a longer term or both. If you make your monthly payment online you can likely get the payoff amount on the same. Pre-approved loans are arranged in advance with a bank or financial institution.

Arranging finance with your car dealer can be a convenient option.

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

How To Get A Car Loan With No Credit History Lendingtree

Car Loan Interest Explained The Easy Way Youtube

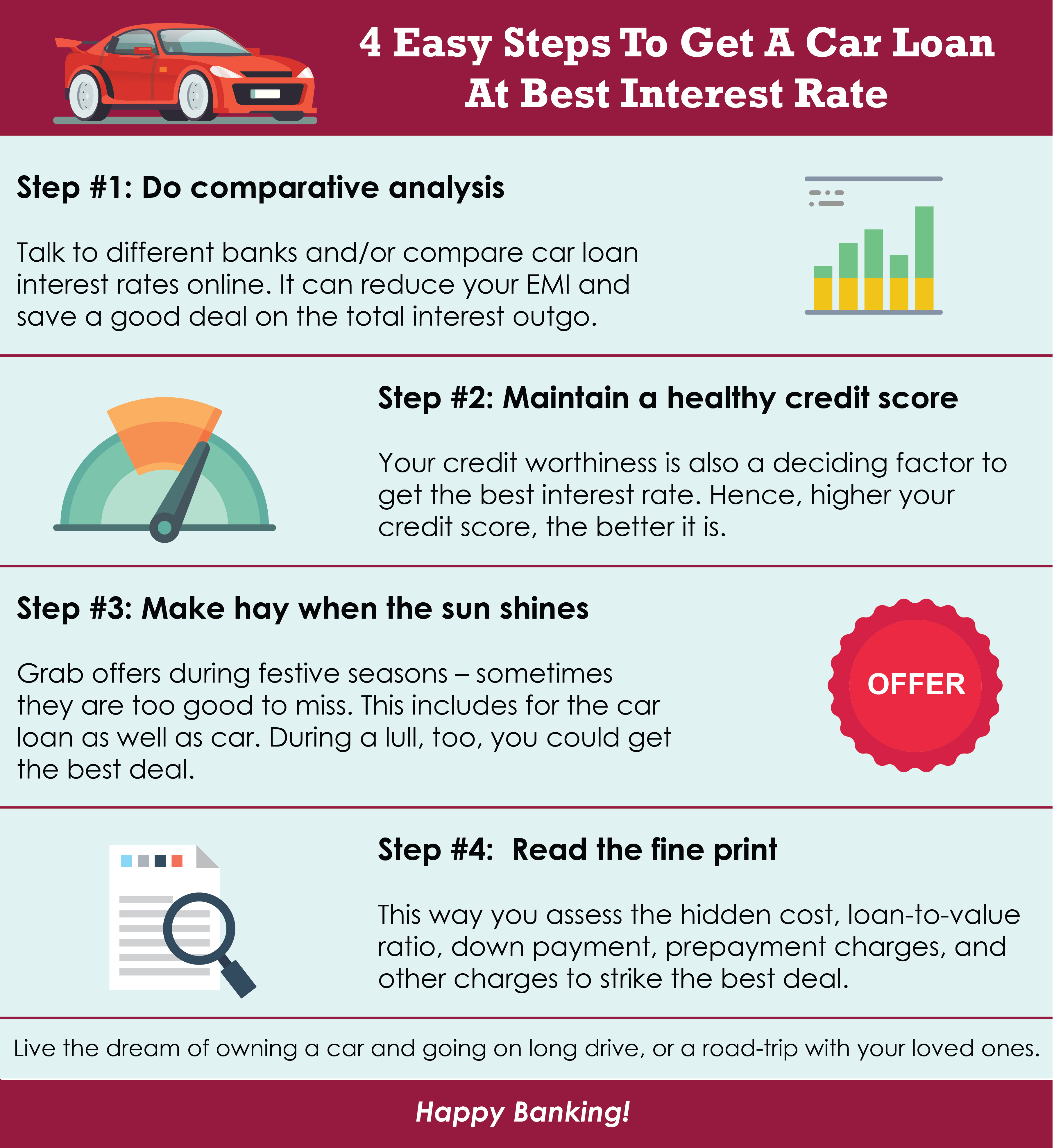

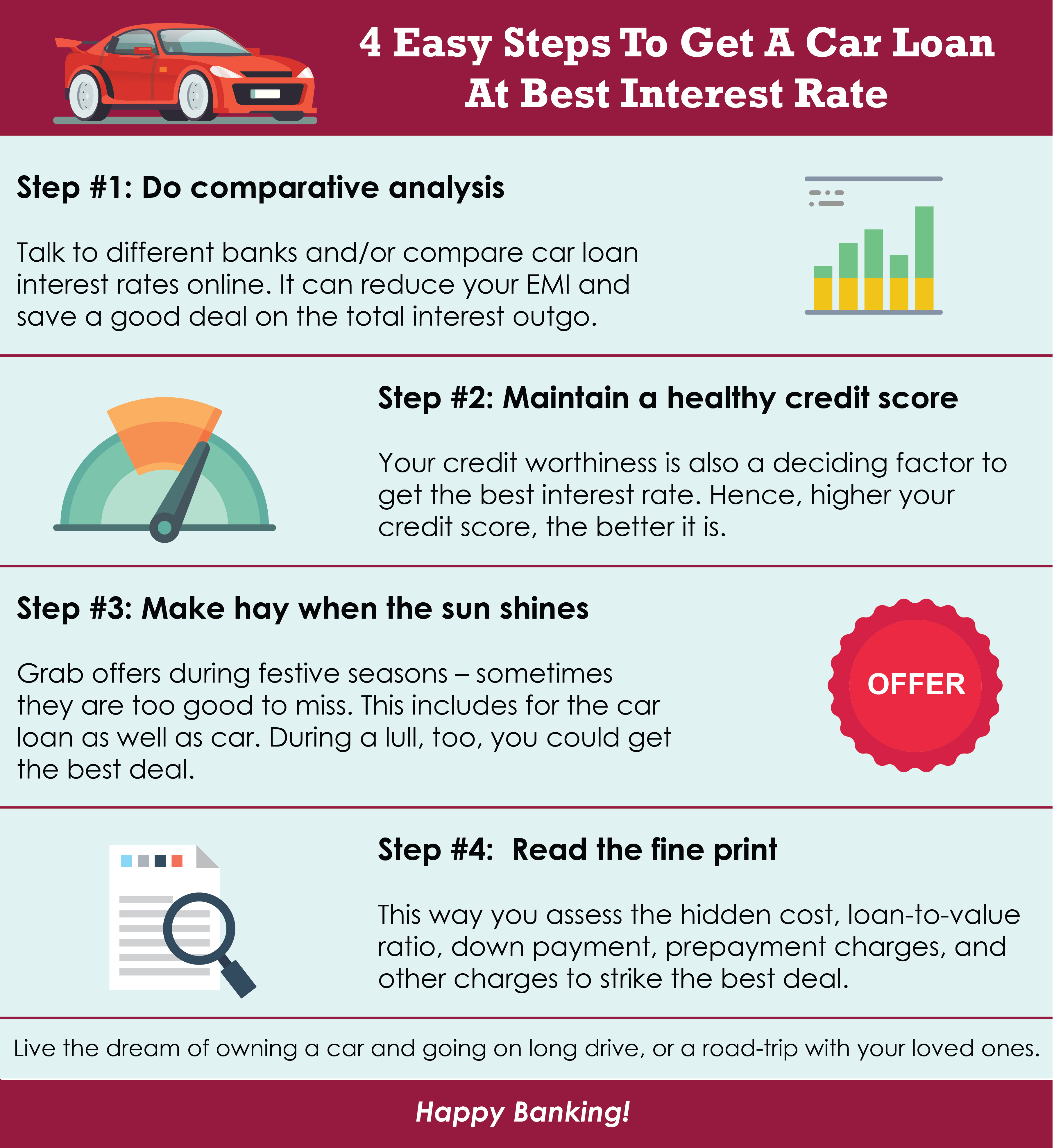

4 Easy Steps To Get A Car Loan At Best Interest Rates Read This Infographic To Know The 4 Easy Steps To Get Aca Car Loan Calculator Car Loans Loan Calculator

How Do Car Loans Work Nextadvisor With Time

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

0 comments

Post a Comment